What are the Q1 2025 Tax Deadlines for Businesses in The Woodlands, TX?

What are the Q1 2025 Tax Deadlines for Businesses in The Woodlands, TX?

The Woodlands, TX: Q1 2025 Business Tax Deadlines

As a business owner in The Woodlands, Texas, staying on top of your tax obligations is crucial for maintaining compliance and avoiding penalties. Our Montgomery County tax experts have compiled this comprehensive guide to help local businesses understand their essential tax deadlines for the first quarter of 2025.

Mark Your Calendar: Key Q1 2025 Tax Dates for Texas Entrepreneurs

January Deadlines: Starting the Year Right

The new year brings immediate tax responsibilities for business owners in The Woodlands and surrounding areas. January is particularly crucial as it includes several federal filing requirements impacting employers and independent contractors.

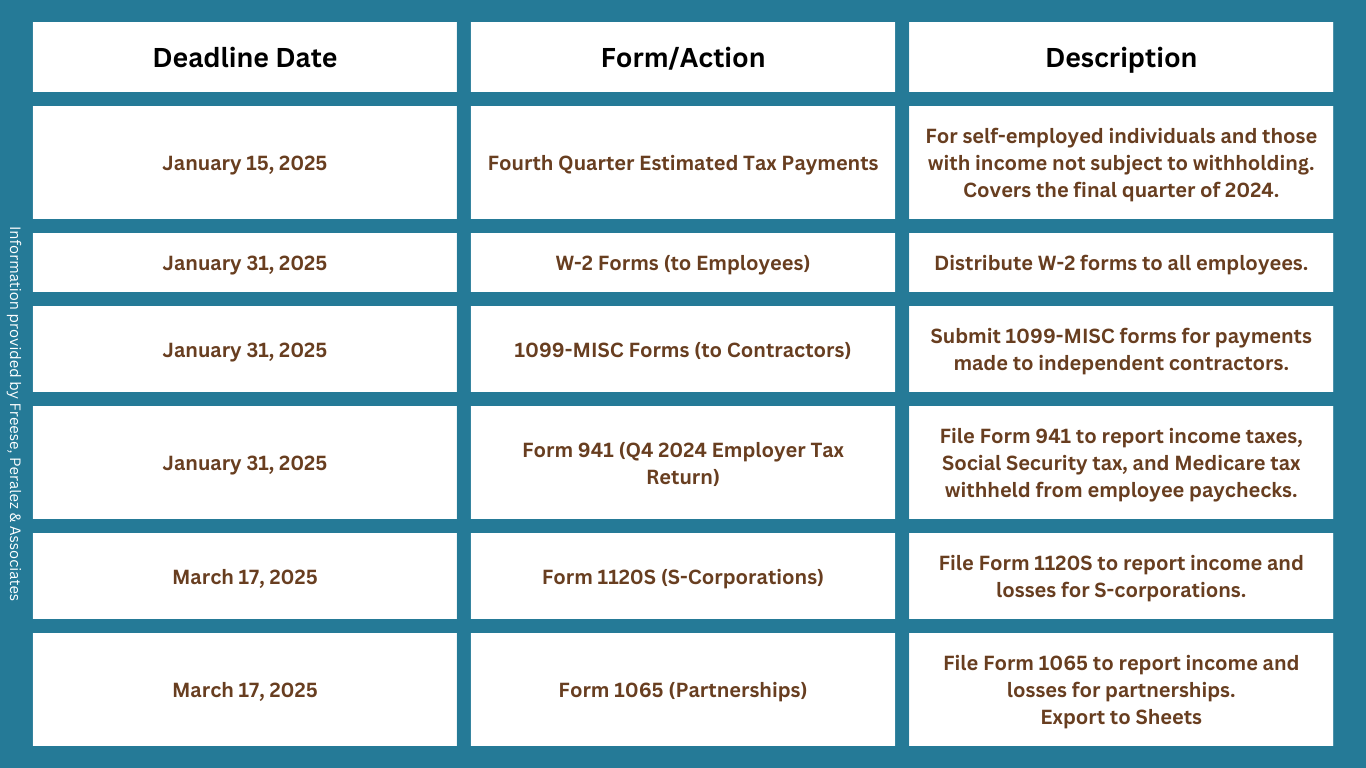

January 15, 2025: Fourth Quarter Estimated Tax Payments

If you're self-employed or receive income that isn't subject to withholding, this deadline is critical. The January 15 payment covers your estimated tax obligation for the final quarter of 2024. For many business owners in Montgomery County, this payment is essential for avoiding underpayment penalties.

January 31, 2025: Employee and Contractor Documentation

This date marks several crucial deadlines:

- Distribution of W-2 forms to all employees

- Submission of 1099-MISC forms for contractor payments

- Filing of Form 941 for Q4 2024 employer tax returns

For businesses in The Woodlands area, meeting these deadlines is particularly important as late submissions can result in significant penalties from both federal and state authorities.

February Updates: Tax Season Begins

February 15, 2025: Early Refund Period

While this date primarily affects individual taxpayers claiming certain credits, business owners should be aware that this marks the beginning of the IRS processing period for returns claiming specific tax credits. This timing can impact cash flow planning for businesses that qualify for various credits.

March Milestones: Business Structure Filing Requirements

March 17, 2025: S-Corporation and Partnership Returns

This crucial deadline affects many local businesses operating as S-corporations or partnerships. Required filings include:

Local Considerations for The Woodlands, TX Business Community

While federal deadlines apply nationwide, Texas businesses face unique considerations. Our state's tax-friendly environment doesn't mean business owners can relax their vigilance. Here in The Woodlands, we've observed that successful businesses typically:

- Maintain organized records throughout the quarter

- Work closely with local tax professionals familiar with Montgomery County business regulations

- Plan ahead for tax payments to manage cash flow effectively

Expert Tips for Tax Season Success

Based on our experience serving businesses in The Woodlands area, we recommend:

- Setting calendar reminders at least two weeks before each deadline

- Keeping separate accounts for tax payments to ensure funds are available

- Maintaining regular communication with your tax professional throughout the quarter

- Reviewing your estimated tax payment strategy regularly to avoid surprises

Need Professional Guidance?

Understanding and meeting tax obligations can be complex and frustrating for busy business owners. Our team of experienced CPAs in The Woodlands specializes in helping local businesses understand and navigate these important deadlines and requirements. Contact us to ensure your business stays compliant and maximizes available tax benefits.

Would you like to schedule an appointment with a CPA today?